Introduction: The Mortgage That Deserves a Warning Label

Adjustable Rate Mortgages (ARMs) often arrive wrapped in attractive promises. Lower interest rates. Smaller monthly payments. Easier qualification. For many homebuyers, especially first-time buyers, these features feel like a lifeline in an expensive housing market.

But beneath the surface, Adjustable Rate Mortgages carry risks that are frequently misunderstood—or worse, ignored.

This is not an article meant to scare you away from ARMs entirely. Instead, it is a buyer beware guide—a clear, honest look at how adjustable rate mortgages really work, why they can become dangerous, and how buyers can protect themselves from costly mistakes.

Because when it comes to ARMs, what you don’t understand can hurt you financially for decades.

What Is an Adjustable Rate Mortgage?

An Adjustable Rate Mortgage is a home loan where the interest rate:

- Is fixed for an initial period

- Then adjusts periodically based on market conditions

When the rate adjusts, the monthly payment changes—sometimes dramatically.

Unlike fixed-rate mortgages, ARMs introduce uncertainty into one of the largest financial commitments most people ever make.

Why Adjustable Rate Mortgages Are So Appealing

ARMs are not popular by accident. They are designed to attract buyers.

Lower Initial Interest Rates

ARMs usually start with interest rates lower than fixed-rate mortgages. This makes:

- Monthly payments look affordable

- Loan qualification easier

- Homes appear within reach

For buyers stretched by high prices, this can feel like the only option.

Smaller Early Payments

Lower rates mean:

- Lower monthly payments

- More short-term cash flow

- Less financial pressure—at first

The keyword is “at first.”

Psychological Comfort at Closing

At the closing table, buyers focus on today’s payment—not tomorrow’s risk.

Many borrowers say:

- “I’ll refinance later.”

- “Rates won’t rise that much.”

- “I won’t live here forever.”

These assumptions are where danger begins.

The Structure of an Adjustable Rate Mortgage

To understand the risk, you must understand the structure.

The Two Phases of an ARM

Every ARM has:

- A fixed-rate introductory period

- A variable-rate adjustment period

The first phase creates comfort.

The second phase introduces uncertainty.

Common ARM Formats

You’ll often see ARMs labeled as:

- 5/1 ARM

- 7/1 ARM

- 10/1 ARM

This means:

- The rate is fixed for the first number of years

- Then adjusts annually afterward

Once the adjustment period begins, predictability ends.

How ARM Rates Actually Adjust

After the fixed period, your new interest rate is calculated using:

1. An Index

The index reflects broader market interest rates. It moves with:

- Inflation

- Central bank policy

- Economic conditions

When rates rise, so does your mortgage rate.

2. A Margin

The margin is set by the lender and added to the index.

Formula:

Index + Margin = New Interest Rate

The margin never changes. The index does.

Interest Rate Caps: Protection or Illusion?

Most ARMs include caps that limit how much rates can rise.

Types of Caps

- Initial cap – Limits the first adjustment increase

- Periodic cap – Limits each adjustment

- Lifetime cap – Maximum rate over the loan’s life

Caps help—but they do not eliminate risk.

A capped increase can still mean hundreds or thousands more per month.

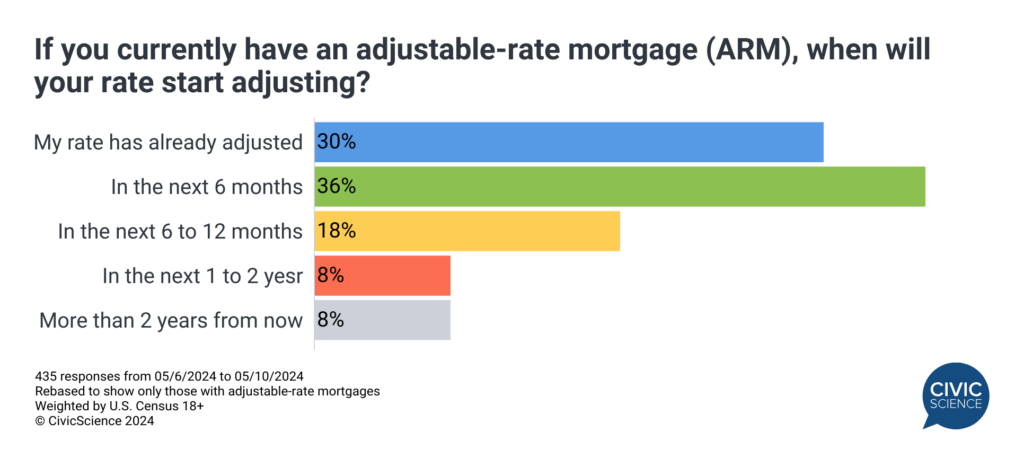

Payment Shock: The ARM’s Most Dangerous Feature

Payment shock occurs when:

- The interest rate jumps

- Monthly payments rise sharply

- Household budgets are overwhelmed

This is not hypothetical. It happens—often.

Many borrowers can afford the introductory payment, but not the adjusted payment.

Why Buyers Underestimate ARM Risk

Optimism Bias

People assume:

- Rates won’t rise too fast

- Their income will increase

- Nothing unexpected will happen

Life rarely cooperates.

Overconfidence in Refinancing

Many buyers believe refinancing is guaranteed.

But refinancing depends on:

- Credit scores

- Home values

- Interest rate environment

- Job stability

When markets tighten, refinancing disappears.

Misunderstanding Loan Documents

ARM disclosures are long, technical, and overwhelming.

Buyers often sign without fully understanding:

- Worst-case payment scenarios

- Adjustment timelines

- Total long-term cost

Complexity favors lenders—not borrowers.

The Long-Term Cost Trap

ARMs can become more expensive than fixed-rate mortgages.

Why?

- Rates often rise over time

- Adjustments compound

- Payments increase when income may no longer grow

Short-term savings can lead to long-term losses.

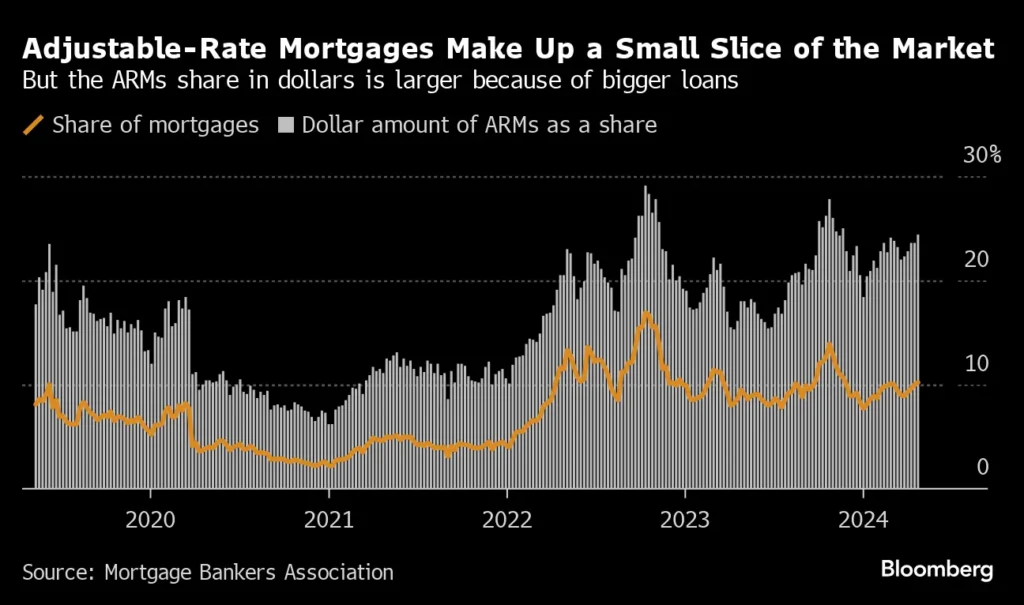

Adjustable Rate Mortgages and Economic Cycles

ARMs are especially dangerous during:

- Rising interest rate cycles

- High inflation environments

- Economic uncertainty

When rates rise quickly, ARM borrowers feel the pain immediately.

Lessons From the Housing Crisis

During the 2008 housing crisis:

- Many borrowers didn’t understand ARMs

- Teaser rates hid future payments

- Refinancing became impossible

- Foreclosures surged

The problem wasn’t ARMs alone—it was misuse and misunderstanding.

Are ARMs Safer Today?

Yes and no.

Modern regulations:

- Require clearer disclosures

- Enforce ability-to-repay rules

- Limit abusive structures

But regulation cannot replace borrower understanding.

The risk still exists.

Who Should Be Extremely Cautious With ARMs

ARMs are especially risky for buyers who:

- Have tight budgets

- Rely on fixed income

- Plan long-term homeownership

- Have little savings

- Are sensitive to payment increases

For these buyers, stability matters more than short-term savings.

When an ARM Might Make Sense

Despite the risks, ARMs can be used responsibly.

They may be suitable if you:

- Plan to sell before adjustments begin

- Have strong income growth

- Maintain significant savings

- Understand worst-case scenarios

- Have a clear exit strategy

ARMs demand discipline—not hope.

ARM vs Fixed-Rate Mortgage: A Reality Check

| Feature | ARM | Fixed-Rate |

|---|---|---|

| Initial payment | Lower | Higher |

| Long-term certainty | Low | High |

| Budget stability | Weak | Strong |

| Risk exposure | High | Low |

| Stress level | Variable | Predictable |

Predictability has value—especially in housing.

The Psychological Cost of Adjustable Mortgages

Financial stress affects:

- Mental health

- Relationships

- Decision-making

Uncertain payments create anxiety that fixed mortgages avoid.

Peace of mind is often worth the higher initial payment.

Questions Every Buyer Must Ask

Before choosing an ARM, ask:

- What is my maximum possible payment?

- Can I afford it comfortably?

- What happens if rates rise quickly?

- What if refinancing isn’t available?

- How long do I truly plan to stay?

If the answers are unclear, the risk is high.

Stress-Testing Your Mortgage Decision

Smart buyers stress-test their loan.

This means:

- Calculating payments at the lifetime cap

- Evaluating income stability

- Building emergency reserves

If the numbers don’t work under pressure, they don’t work at all.

The Lender’s Perspective

Lenders profit from:

- Interest rate adjustments

- Extended loan durations

- Borrower optimism

This doesn’t mean lenders are evil—but incentives matter.

Buyers must protect themselves.

Avoiding ARM Regret

To avoid regret:

- Read disclosures carefully

- Ask uncomfortable questions

- Ignore sales pressure

- Choose certainty over excitement

A mortgage is not a gamble—it’s a commitment.

Alternatives to Adjustable Rate Mortgages

Buyers should consider:

- Fixed-rate mortgages

- Smaller home purchases

- Larger down payments

- Waiting for better conditions

Sometimes the safest decision is patience.

Final Thoughts: Buyer Beware Means Buyer Be Informed

Adjustable Rate Mortgages are not scams—but they are dangerous when misunderstood.

They reward:

- Planning

- Discipline

- Financial strength

They punish:

- Assumptions

- Optimism

- Lack of preparation

“Buyer beware” doesn’t mean “never buy.”

It means know exactly what you’re buying.

Before choosing an ARM, remember this:

Low payments today can cost you control tomorrow.

When it comes to your home and your financial future, certainty is often the smartest investment of all.

Word Count:

492

Summary:

Remember when your mom told you that if it sounds too good to be true, it probably is? The same could be said about Adjustable Rate Mortgages (or ARM in industry lingo). These guys can be a wolf dressed in sheep’s clothing and if you aren’t careful they are going to huff and puff and take your home away!

Keywords:

adjustable rate mortgage

Article Body:

Remember when your mom told you that if it sounds too good to be true, it probably is? The same could be said about Adjustable Rate Mortgages (or ARM in industry lingo). These guys can be a wolf dressed in sheep’s clothing and if you aren’t careful they are going to huff and puff and take your home away!

An Adjustable Rate Mortgage works like this. Initially, you are probably going to be paying anywhere from 2 – 3 % below the current market interest rates on your mortage. For many people, this allows them to buy a bigger house, one that would normally be outside their price range. The normal reasoning is that by the time the loan adjusts – which could be a year from now, or as much as 7 – 10 years from now – they will be earning more, the economy will be better, etc.

The problem they run into is that as good as we hope the future is – sometimes it isn’t. Lives change, the economy fumbles or we change jobs. Suddenly, we went from two incomes to one or we just aren’t making as much as we were a few years back. Even worse, interest rates rise and when it comes time for our ARM to adjust it goes up – way up.

Some ARM’s adjust every year and are based off current interest rates set by the Federal Reserve. Sometimes, this can be a good thing as interest rates may have fallen and you could end up paying in interest than you were at the start of your loan. However, as is most often the case, the exact opposite is true – interest rates have risen, and you end up paying more each month. The budget starts to get stretched a little thinner.

There are other ARM’s that adjust after a specified number of years – say 7 to 10. When they finally kick it, it can be a real sticker shock for the homeowner. If they haven’t planned for this financially it could mean the difference between them keeping or losing their home. In some cases, monthly mortgage payments could double in size depending on how low your interest rate was before the adjustment and what current interest rates are.

So what’s the smart move for most home owners? Stick with traditional mortgages that have a predefined interest rate that is locked in over the life of the loan. If market conditions warrant sometime down the road, you can always look into refinancing your mortgage and getting a lower interest rate.

Adjustable rate mortgages are good for those who like to gamble – and some argue they are good for families just starting out who know they will need a bigger house in the future and will have larger incomes in the future as well. However, as we all know, nothing is as certain in life as change and sometimes the smart homeowner knows when to play it safe and keep a roof over his or her head!

Tinggalkan Balasan