Introduction: The Mortgage That Moves With the Market

Adjustable Rate Mortgage loans—commonly called ARMs—are among the most misunderstood financial products in the housing market. To some borrowers, they represent opportunity: lower initial payments, easier qualification, and short-term affordability. To others, they symbolize risk, uncertainty, and painful payment shocks.

The truth lies somewhere in between.

An Adjustable Rate Mortgage is neither good nor bad by nature. It is a financial tool, and like any tool, its usefulness depends on how well it is understood and how wisely it is used.

This article provides a complete, plain-English explanation of adjustable rate mortgage loans, including how they work, why lenders offer them, the benefits and risks involved, and how borrowers can decide whether an ARM fits their financial goals.

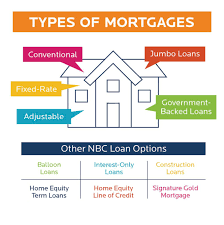

What Is an Adjustable Rate Mortgage Loan?

An Adjustable Rate Mortgage loan is a home loan where the interest rate is not fixed for the entire life of the loan.

Instead, the loan:

- Begins with a fixed interest rate for a set period

- Then adjusts periodically based on market conditions

- Causes monthly payments to rise or fall over time

This structure makes ARMs fundamentally different from fixed-rate mortgages, which maintain the same interest rate from the first payment to the last.

Why Adjustable Rate Mortgages Exist

ARMs exist to balance risk between borrowers and lenders.

For lenders:

- ARMs reduce long-term interest rate risk

- They allow rates to adjust with economic conditions

For borrowers:

- ARMs often offer lower initial rates

- They provide flexibility for short- to mid-term homeownership

In volatile or rising-rate environments, ARMs shift some uncertainty from lenders to borrowers.

The Two Phases of an Adjustable Rate Mortgage

Every ARM has two distinct phases.

Phase 1: The Initial Fixed-Rate Period

During this phase:

- The interest rate is locked

- Monthly payments remain stable

- The rate is typically lower than fixed-rate mortgages

Common fixed periods include:

- 3 years

- 5 years

- 7 years

- 10 years

This period is designed to attract borrowers with lower upfront costs.

Phase 2: The Adjustment Period

After the fixed period ends:

- The interest rate begins to adjust

- Adjustments occur on a set schedule

- Payments can increase or decrease

This phase introduces uncertainty and risk.

Understanding ARM Loan Terminology

ARM Naming Structure

ARMs are often labeled with numbers such as:

- 5/1 ARM

- 7/1 ARM

- 10/1 ARM

The first number represents:

- The number of years the rate is fixed

The second number represents:

- How often the rate adjusts afterward (in years)

A 5/1 ARM is fixed for 5 years and adjusts annually after that.

How ARM Interest Rates Are Calculated

Once the loan enters the adjustment period, the new interest rate is calculated using two components:

1. The Index

The index reflects general market interest rates. Common indexes include:

- SOFR (Secured Overnight Financing Rate)

- Treasury-based indexes

- Other lender-specified benchmarks

Indexes fluctuate based on economic conditions.

2. The Margin

The margin is:

- A fixed percentage set by the lender

- Added to the index to determine the final rate

Example:

- Index: 4.0%

- Margin: 2.5%

- New rate: 6.5%

The margin does not change over the life of the loan.

Interest Rate Caps: Limiting the Damage

Most adjustable rate mortgage loans include interest rate caps, which limit how much rates can increase.

Initial Adjustment Cap

Limits how much the rate can rise at the first adjustment.

Periodic Cap

Limits how much the rate can change at each subsequent adjustment.

Lifetime Cap

Limits the maximum interest rate over the entire loan term.

Caps reduce risk—but they do not eliminate it.

Payment Shock: The Biggest ARM Risk

Payment shock occurs when:

- The interest rate increases significantly

- Monthly payments jump sharply

This can happen when:

- The initial rate was very low

- Market rates rise quickly

- Borrowers fail to prepare

Payment shock is the primary reason ARMs receive criticism.

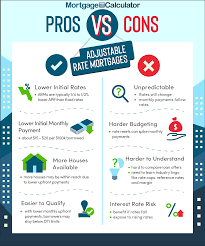

Advantages of Adjustable Rate Mortgage Loans

Despite the risks, ARMs offer real benefits in the right situations.

Lower Initial Interest Rates

ARMs usually start with rates lower than fixed-rate loans, reducing early payments.

Improved Short-Term Affordability

Lower payments can help:

- First-time buyers qualify

- Borrowers manage early cash flow

- Investors maximize leverage

Strategic Use for Short-Term Ownership

If you plan to:

- Sell

- Refinance

- Relocate

before the adjustment period begins, an ARM can reduce total interest paid.

Potential Savings in Stable or Falling Rate Environments

If market rates remain stable or decline, ARM payments may stay manageable or decrease.

Risks of Adjustable Rate Mortgage Loans

ARMs are not suitable for every borrower.

Interest Rate Uncertainty

Payments are unpredictable once the loan adjusts.

Budget Pressure

Rising payments can strain household finances.

Refinancing Risk

Refinancing may not be possible if:

- Home values fall

- Credit scores decline

- Interest rates rise sharply

Long-Term Cost Risk

Over long periods, ARMs can cost more than fixed-rate mortgages.

ARM vs Fixed-Rate Mortgage: A Comparison

| Feature | ARM | Fixed-Rate |

|---|---|---|

| Initial rate | Lower | Higher |

| Payment stability | Variable | Stable |

| Long-term predictability | Low | High |

| Risk level | Higher | Lower |

| Flexibility | High | Moderate |

Choosing between them is about strategy—not trends.

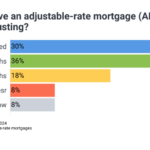

Who Should Consider an Adjustable Rate Mortgage?

An ARM may be appropriate if you:

- Expect rising income

- Plan short- to mid-term homeownership

- Have strong cash reserves

- Understand worst-case payment scenarios

ARMs reward planning—not optimism.

Who Should Avoid Adjustable Rate Mortgages?

Avoid ARMs if you:

- Require fixed monthly payments

- Have tight budgets

- Are risk-averse

- Plan long-term ownership

Stability is more valuable than short-term savings.

The Role of ARMs in Real Estate Investing

Many real estate investors use ARMs strategically.

Reasons include:

- Lower early costs

- Improved cash flow

- Short holding periods

However, investors must model:

- Rising rate scenarios

- Exit timing

- Refinancing risk

The 2008 Crisis and ARM Misuse

ARMs gained a negative reputation after the 2008 housing crisis.

Problems arose because:

- Borrowers didn’t understand adjustments

- Teaser rates were misleading

- Risk was ignored

The lesson wasn’t that ARMs are bad—but that misunderstanding is dangerous.

Regulatory Improvements Since the Crisis

Modern ARM loans now require:

- Clear disclosures

- Ability-to-repay verification

- Caps and safeguards

While safer today, responsibility still rests with the borrower.

Key Questions to Ask Before Choosing an ARM

Before signing, ask:

- What is my maximum possible payment?

- When does the first adjustment occur?

- What index is used?

- What are the caps?

- Can I afford the loan at the capped rate?

If the answer is no—reconsider.

Stress-Testing Your ARM Loan

Smart borrowers plan for worst-case scenarios.

Stress testing includes:

- Calculating payments at the lifetime cap

- Evaluating income stability

- Ensuring emergency savings

Hope is not a strategy.

Refinancing an ARM: Opportunity or Trap?

Refinancing can:

- Lock in fixed rates

- Reduce risk

- Extend loan terms

But it depends on:

- Market conditions

- Credit health

- Property value

Never assume refinancing will be easy.

Common Myths About Adjustable Rate Mortgages

“Rates will always stay low”

False. Markets change.

“Caps fully protect me”

They limit—but don’t prevent increases.

“I’ll just sell if rates rise”

Market conditions may prevent that.

Using ARMs Responsibly

Responsible ARM use requires:

- Clear exit strategies

- Conservative assumptions

- Ongoing financial monitoring

ARMs punish complacency and reward preparation.

The Psychological Side of Adjustable Loans

Payment uncertainty creates stress.

Borrowers must be comfortable with:

- Change

- Market volatility

- Financial discipline

If uncertainty causes anxiety, an ARM may not be suitable.

Final Thoughts: Knowledge Turns Risk Into Strategy

Adjustable Rate Mortgage loans are powerful—but unforgiving when misunderstood.

They are best viewed as:

- Strategic tools

- Short- to mid-term solutions

- Loans requiring active management

When used intentionally, ARMs can save money and increase flexibility.

When used blindly, they can create long-term financial pressure.

The question is not whether ARMs are good or bad.

The real question is:

Do you fully understand the loan you’re committing to—and can you afford it if conditions change?

In mortgages, clarity is protection.

Word Count:

372

Summary:

Adjustable rate mortgages (ARM), developed when mortgage interest rates were high, can help you finance the purchase of a home with low interest rates. An ideal choice for those who expect their income to rise or move in a couple of years, an ARM also increases your risk for higher payments. Fortunately, lenders also offer safeguards to limit some of your risk to excessively high interest rates.

ARM Features

An ARM starts with a low interest rate, up to 3% lower than a …

Keywords:

Article Body:

Adjustable rate mortgages (ARM), developed when mortgage interest rates were high, can help you finance the purchase of a home with low interest rates. An ideal choice for those who expect their income to rise or move in a couple of years, an ARM also increases your risk for higher payments. Fortunately, lenders also offer safeguards to limit some of your risk to excessively high interest rates.

ARM Features

An ARM starts with a low interest rate, up to 3% lower than a fixed rate mortgage. With lower rates, you usually qualify to borrow more than with a fixed rate home loan.

ARMs usually start with a fixed rate period and end with fluctuating yearly interest rates, increasing or decreasing your monthly payment. So a 3/1 ARM means 3 years of fixed rates with interest rates changing every year after that. Interest rates are based on an index, usually the rate on the T-bill or LIBOR, and the margin the lender adds to the index.

ARM Safeguards

In order to protect borrowers from sky-rocketing monthly payments, mortgage lenders put in place safeguards. For example, a point cap limits how much interest rates can rise monthly and over the life of the loan. There are also ceiling limits on how low rates can go, protecting the lender.

Another safeguard is a dollar cap on monthly payments. However, if interest rates rise higher than the dollar cap allows, you may end up with a longer loan. Many financing companies also allow you to convert your ARM to a fixed rate mortgage after a predetermined period.

ARM Considerations

While an ARM has many benefits, there are other considerations to look at. For instance, interest rates can rise 4% or more over the course of your home loan. If you plan to stay in your home for several years, a fixed rate may offer lower interest costs in the long term. ARMs are also unpredictable, which makes planning long term financing goals difficult.

Before you apply for an ARM, make sure you are comfortable with the level of risk involve. However, if you expect your income to rise in the future or to move, then you may be saving yourself a lot of money in interest payments with an ARM.

Tinggalkan Balasan