Introduction: Understanding the Mortgage That Changes Over Time

An Adjustable Rate Mortgage (ARM) can look very attractive at first glance. Lower initial payments, easier qualification, and short-term savings often draw borrowers in.

But behind that low starting rate is a loan designed to change over time—sometimes in ways borrowers don’t fully expect.

This article explains what an adjustable rate mortgage is, how it works, its advantages, risks, and who it may or may not be suitable for.

What Is an Adjustable Rate Mortgage (ARM)?

An Adjustable Rate Mortgage is a home loan with an interest rate that:

- Starts fixed for a set period

- Then adjusts periodically based on market rates

Unlike a fixed-rate mortgage, the payment on an ARM can increase or decrease over time.

How an ARM Works

An ARM is made up of two main phases:

1. The Initial Fixed Period

During this phase:

- The interest rate is fixed

- Payments remain stable

- Rates are usually lower than fixed-rate mortgages

Common initial periods include:

- 3 years

- 5 years

- 7 years

- 10 years

2. The Adjustment Period

After the fixed period ends:

- The interest rate adjusts at scheduled intervals

- Payments may increase or decrease

- Adjustments are based on a market index

This is where uncertainty begins.

Common ARM Structures

You may see ARMs described as:

- 5/1 ARM – Fixed for 5 years, adjusts annually

- 7/1 ARM – Fixed for 7 years, adjusts annually

- 10/1 ARM – Fixed for 10 years, adjusts annually

The first number is the fixed period.

The second number is how often the rate adjusts afterward.

What Determines ARM Rate Changes?

ARM adjustments depend on:

- A benchmark index (such as SOFR or similar rates)

- A lender margin

- Market interest conditions

When rates rise, payments rise. When rates fall, payments may decrease—but not always significantly.

Interest Rate Caps: Your Safety Net

Most ARMs include caps that limit how much rates can increase.

Common caps include:

- Initial cap – Limits first adjustment increase

- Periodic cap – Limits future adjustments

- Lifetime cap – Maximum rate over the loan’s life

Caps reduce risk—but do not eliminate it.

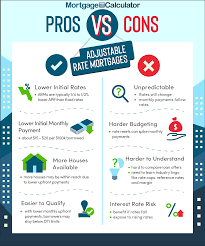

Advantages of Adjustable Rate Mortgages

ARMs can be useful in specific situations.

Benefits include:

- Lower initial interest rates

- Lower early monthly payments

- Increased buying power

- Potential savings if rates stay low

For short-term homeowners, ARMs can be cost-effective.

Risks of Adjustable Rate Mortgages

The biggest risk is payment uncertainty.

Potential downsides include:

- Sudden payment increases

- Budget strain if rates rise sharply

- Difficulty refinancing during market downturns

- Long-term costs exceeding fixed-rate loans

ARMs require careful planning.

Who Might Benefit From an ARM?

An ARM may make sense if you:

- Plan to sell or refinance before the rate adjusts

- Expect income growth

- Understand and can absorb payment increases

- Are using it strategically, not emotionally

ARMs are tools—not shortcuts.

Who Should Avoid an ARM?

ARMs may be risky if you:

- Need predictable monthly payments

- Have tight cash flow

- Plan to stay long-term

- Are sensitive to interest rate changes

Stability matters more than short-term savings.

ARM vs Fixed-Rate Mortgage

| Feature | ARM | Fixed-Rate |

|---|---|---|

| Initial rate | Lower | Higher |

| Payment stability | Variable | Stable |

| Long-term certainty | Low | High |

| Risk level | Higher | Lower |

The right choice depends on goals, not trends.

Common ARM Misunderstandings

- “Rates will always stay low” ❌

- “I’ll refinance easily later” ❌

- “Caps protect me completely” ❌

Assumptions are dangerous in lending decisions.

Questions to Ask Before Choosing an ARM

Always ask:

- How high can my payment go?

- When does the first adjustment occur?

- What index is used?

- What are the caps?

- Can I afford the worst-case scenario?

Clarity prevents regret.

Final Thoughts: Know the Loan Before You Sign

An Adjustable Rate Mortgage is neither good nor bad by default.

It’s powerful when used intentionally—and dangerous when misunderstood.

Before choosing an ARM:

- Understand the structure

- Stress-test your budget

- Plan for rising rates, not falling ones

A mortgage should support your financial future—not surprise it.

Word Count:

305

Summary:

Get information on this money saving mortgage. Find out more about adjustable rate mortgages (ARM’s).

Keywords:

adjustable rate mortgage, arm, variable,loan

Article Body:

What Is An Adjustable Rate Mortgage (ARM)?

An adjustable rate mortgage is certain type of home mortgage that has a variable interest rate. Compared to a 30 year fixed mortgage, the borrower’s payment is considerabely less. This is due to the transfer of risk from the lender to the borrower.

The Structure Of An ARM

There is a wide variety of adjustable rate mortgage�s. The 2 main components can be recognized by it�s name.

When you review the different types of ARM�s, you�ll notice 2 numbers. You can get a 1:1, 3:1, 5:1, 7:1, or even a 10:1. This just a short list, but to explain further, the first number is the fixed period. Even though the name of an adjustable rate mortgage implies that it contains a fluctuating interest rate, these loans have a initial fixed period.

For example, if you are looking at a 5:1 ARM, the loan will be fixed for 5 years. Then after the initial period, the rate will adjust.

The second number shows how often the rate will adjust. Since all of the examples shown above end with the number 1, these loans will adjust every year after the initial fixed period. If the second number was a 2, the loan rate will adjust every 2 years.

Consider Your Needs Before You Apply

Before applying for a home mortgage, make sure that you consider your needs. Although the thoughts of a fluctuating interest rate might be scary, there are some safeguards, such as interest rate caps, that protect the borrower from burdening issues that American�s once faced. The most important part of choosing the right mortgage is to look at what fit�s your situation the best. Every home owner has different circumstances in life, and every home has a loan which suits a families, or individuals finances and comfort level.

Tinggalkan Balasan