Introduction: Why ARM Rates Feel So Confusing

Adjustable Rate Mortgages (ARMs) often look simple on the surface. A lower starting rate, a predictable payment for a few years, and the promise of affordability. But once the adjustment period begins, many borrowers suddenly ask the same question:

“Why did my mortgage rate change—and who decided the new rate?”

The answer is more complex than most people realize.

ARM rates are not random. They are determined by a structured formula tied to broader economic forces, lender policies, and loan-specific terms. Understanding how ARM rates are determined is essential for anyone considering—or already holding—an adjustable rate mortgage.

This article breaks down exactly how ARM rates are calculated, what influences them, why they change, and how borrowers can anticipate future adjustments instead of being surprised by them.

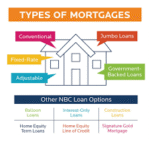

What Makes Adjustable Rate Mortgages Different

Unlike fixed-rate mortgages, ARMs are designed to change.

A fixed-rate mortgage:

- Locks the interest rate for the life of the loan

- Offers payment stability

- Transfers interest-rate risk to the lender

An adjustable rate mortgage:

- Shares interest-rate risk with the borrower

- Adjusts rates periodically

- Reflects current market conditions

Understanding rate determination is the key to understanding ARM risk.

The Two Stages Where ARM Rates Are Set

ARM rates are determined in two very different stages.

Stage 1: The Introductory (Teaser) Rate

The initial ARM rate is:

- Set by the lender

- Often discounted

- Designed to attract borrowers

This rate is not purely market-driven. It is a marketing decision.

Stage 2: The Adjustment Rate

Once the fixed period ends, the rate becomes:

- Formula-based

- Market-linked

- Contractually defined

This is where long-term cost is determined.

Understanding the ARM Rate Formula

ARM rates are calculated using a simple but powerful formula:

Index + Margin = Your New Interest Rate

Each component plays a critical role.

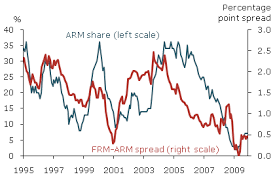

The Index: The Market’s Influence on Your Mortgage

The index is a benchmark interest rate that reflects broader economic conditions.

It is:

- Publicly available

- Market-driven

- Outside the lender’s control

When the index rises or falls, your ARM rate follows.

Common ARM Indexes

Different loans use different indexes. Common examples include:

- SOFR (Secured Overnight Financing Rate)

- Treasury-based rates

- Other approved financial benchmarks

Each index behaves differently, but all respond to:

- Inflation

- Central bank policy

- Economic growth

- Global financial conditions

Why Index Choice Matters

Not all indexes move at the same speed or magnitude.

Some are:

- More volatile

- Faster to react to market changes

Others are:

- Slower

- More stable

The index used in your ARM directly affects how quickly and how much your rate changes.

The Margin: The Lender’s Guaranteed Profit

The margin is a fixed percentage added to the index.

Key facts about margins:

- Set by the lender at loan origination

- Never change

- Reflect borrower risk and market competition

Even if the index drops, the margin ensures lender profitability.

What Determines Your Margin?

Margins are influenced by:

- Credit score

- Loan size

- Down payment

- Market competition

- Lender risk tolerance

Two borrowers with the same index can have very different ARM rates due to different margins.

How Initial ARM Rates Are Chosen

Introductory ARM rates are not purely formula-based.

Lenders consider:

- Market competition

- Borrower demand

- Expected future rate movements

- Profit models

Low introductory rates are designed to shift future risk to the borrower.

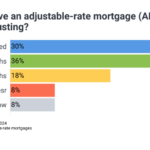

The Fixed Period: Calm Before the Adjustment

During the fixed period:

- The index is irrelevant

- Payments are stable

- Borrowers often feel safe

This period can last:

- 3 years

- 5 years

- 7 years

- 10 years

Longer fixed periods usually come with slightly higher initial rates.

When Does the ARM Rate First Adjust?

The first adjustment occurs:

- Immediately after the fixed period ends

- On a date specified in the loan agreement

This adjustment often results in the largest payment change.

Interest Rate Caps: How Much Can Rates Move?

ARM rate determination is limited by interest rate caps.

Initial Adjustment Cap

Limits how much the rate can increase at the first adjustment.

Example:

- Initial rate: 3%

- Initial cap: 2%

- Maximum first adjustment rate: 5%

Periodic Adjustment Cap

Limits how much the rate can change at each adjustment afterward.

This cap prevents sudden spikes—but not gradual increases.

Lifetime Cap

Sets the maximum interest rate over the life of the loan.

This defines the worst-case scenario.

Why Caps Don’t Eliminate Risk

Caps limit speed—not direction.

Over time:

- Rates can still reach the lifetime cap

- Payments can still become unaffordable

- Budget pressure can build slowly

Caps soften the blow, but they do not guarantee safety.

How Often ARM Rates Adjust

Adjustment frequency depends on loan structure.

Common schedules include:

- Annual adjustments (most common)

- Semi-annual adjustments

- Monthly adjustments (rare)

More frequent adjustments increase uncertainty.

Economic Forces That Drive ARM Rate Changes

ARM rates respond directly to macroeconomic conditions.

Inflation

Higher inflation leads to:

- Higher benchmark rates

- Higher ARM rates

Central Bank Policy

Interest rate hikes by central banks:

- Increase borrowing costs

- Raise ARM indexes

- Increase monthly payments

Economic Growth or Recession

Strong economies tend to push rates higher.

Weak economies often push rates lower.

ARM borrowers are exposed to these cycles.

Why ARM Rates Often Rise Over Time

Historically:

- Long-term interest rates trend upward

- Inflation erodes purchasing power

- Lenders price in risk

This makes long-term ARM ownership inherently risky.

Payment Calculation After Rate Adjustment

When the rate adjusts:

- The remaining loan balance

- The remaining loan term

- The new interest rate

are used to recalculate your monthly payment.

Even small rate increases can significantly raise payments.

Negative Amortization (Rare but Dangerous)

Some older or exotic ARMs allowed:

- Payments below interest owed

- Loan balances to grow

Most modern ARMs restrict this—but borrowers should still verify.

ARM Rate Determination and Credit Risk

Your credit score does not change the index—but it affects:

- Margin at origination

- Refinancing ability later

Poor credit limits your exit options.

Refinancing Risk: A Key ARM Variable

Many ARM borrowers assume refinancing will be easy.

But refinancing depends on:

- Market rates

- Home value

- Credit profile

- Employment stability

ARM rate determination matters most when refinancing is unavailable.

How Lenders Benefit From ARM Rate Structures

Lenders benefit because:

- Risk shifts to borrowers

- Rates adjust upward automatically

- Long-term interest income increases

This doesn’t make ARMs bad—but incentives matter.

ARM Rate Disclosure: What to Look For

Always review:

- Index name

- Margin amount

- Adjustment frequency

- Caps

- Worst-case payment examples

These details determine your financial future.

Stress-Testing ARM Rates

Smart borrowers calculate:

- Payment at first adjustment

- Payment at lifetime cap

- Affordability under worst-case scenarios

If the numbers don’t work under stress, they don’t work at all.

ARM Rates vs Fixed Rates Over Time

Fixed-rate mortgages:

- Offer predictability

- Protect against rising rates

ARMs:

- Offer lower entry costs

- Expose borrowers to long-term uncertainty

Rate determination is the trade-off.

Psychological Impact of Adjustable Rates

Uncertainty creates stress.

Many ARM borrowers experience:

- Anxiety during adjustment periods

- Fear during rate hikes

- Budget instability

Financial peace has real value.

Who Should Pay Close Attention to ARM Rate Determination

ARM rate mechanics matter most for borrowers who:

- Plan long-term homeownership

- Have limited income growth

- Operate on tight budgets

- Are risk-averse

Understanding rates protects against regret.

When ARM Rate Risk Can Be Managed

ARM rate risk is manageable if:

- The loan is short-term

- Exit strategies are realistic

- Cash reserves are strong

- Worst-case scenarios are affordable

ARMs require active financial management.

Common ARM Rate Myths

- “Rates only go up slowly” ❌

- “Caps prevent big increases” ❌

- “The index is predictable” ❌

Markets don’t care about personal plans.

Knowledge Is the Only Real Protection

ARM rates are determined by:

- Market forces

- Contract terms

- Economic cycles

Borrowers who understand these factors:

- Make better decisions

- Avoid surprises

- Maintain control

Those who don’t often pay the price later.

Final Thoughts: ARM Rates Don’t Change—Your Exposure Does

Adjustable Rate Mortgages don’t randomly raise rates.

They do exactly what they were designed to do:

adjust with the market.

The real question isn’t:

“Why did my rate change?”

It’s:

“Did I understand how it would change—and could I afford it when it did?”

ARM rate determination is not hidden knowledge.

It is written clearly in the loan structure—if you know where to look.

In mortgage decisions, understanding rate mechanics isn’t optional.

It’s protection.

Word Count:

539

Summary:

Adjustable rate mortgages are to home buyers as carrots are to bunnies � very tempting. The secret to figuring out if an adjustable rate mortgage is a good deal is the rate index used.

Keywords:

adjustable rate mortgages, t-bills, treasure bills, interest rates, libor, cost of funds index, cofi

Article Body:

Adjustable rate mortgages are to home buyers as carrots are to bunnies � very tempting. The secret to figuring out if an adjustable rate mortgage is a good deal is the rate index used.

Indexes � Setting Rates

Lenders really want your business and are willing to create enticing loan products to get it. Occasionally, lenders will offer adjustable rate mortgages that offer a lot of carrot on the front end, but none on the back end. These loans are typically offered to you with an insanely low initial interest rate, which has you looking at mansions and other structures completely out of your realistic price range. The problem with these loans is the rate rises dramatically after six months or a year when the rate becomes pegged to an index.

Indexes are a unique animal when it comes to the mortgage industry. An index is a calculation of general interest rates charged across a number of financial markets that a bank uses to set a real interest rate on your loan. Common financial markets or products considered in this index include six month certificate deposit rates at local banks, LIBOR, T-Bills and so on. Let�s take a closer look.

- Certificate Deposits � Better known as �CDs�, these are the fixed time period investing vehicles you can get at your local bank. You agree to deposit a certain amount for six months and the bank gives you a guaranteed interest rate of return such as three percent.

- T-Bills � Officially known as Treasury Bills, T-Bills are the credit cards for the federal government. Currently, Uncle Sam owes trillions of dollars on his and pays a certain interest rate on the debit. The interest rate is used by lenders in calculating your ARM rates.

- Cost of Funds Index � It gets a bit technical, but this index represents the rates being used by banks in Nevada, Arizona and California as an average.

- LIBOR � Officially known as the London Interbank Offered Rate Index, LIBOR is a popular index upon which to base ARM rates. Now, you are probably wondering what London has to do with the United States real estate market. LIBOR represents the interest rate international banks charge to borrow U.S. dollars on the London currency markets. LIBOR rates move quickly and can result in unstable interest rate moves for your adjustable mortgage.

Why Indexes Matter

Indexes matter because they set the base of the interest rates charged on your loan. Assume you apply for an adjustable rate mortgage based on a LIBOR index. Assume the LIBOR rate is 2.2 percent when you apply. The 2.2 percent is your starting interest rate. If the LIBOR shoots up one percent in eight months, your loan will do the same.

Importantly, the index rate used for your loan is not the interest rate you will pay. Instead, you have to add the banks margin on top of the index rate. Most banks will charge two to three percent on top of the index rate. Using our LIBOR example, the initial interest rate of your loan would be 2.2 percent plus whatever the bank is using as a spread. Obviously, this means you need to closely read the loan documents to figure out how the game is being played!

Tinggalkan Balasan